The Motorcycle Law Group represents motorcycle riders in Virginia and North Carolina,. All of those states – except Virginia – require motorcyclists to carry minimum insurance coverage. Although it is not legally required in Virginia, riders who choose not to acquire motorcycle insurance are charged a $500 opt-out fee when renewing their registration. It should be noted that annual minimum coverage premiums are likely not that much more expensive than the fee.

The Virginia fee entitles you to no coverage whatsoever. If you were to get in a motorcycle accident there’s a possibility you would receive no compensation for your bike damage or injuries and could potentially be forced to pay damage you cause out of pocket.

Minimum Coverage in Most States

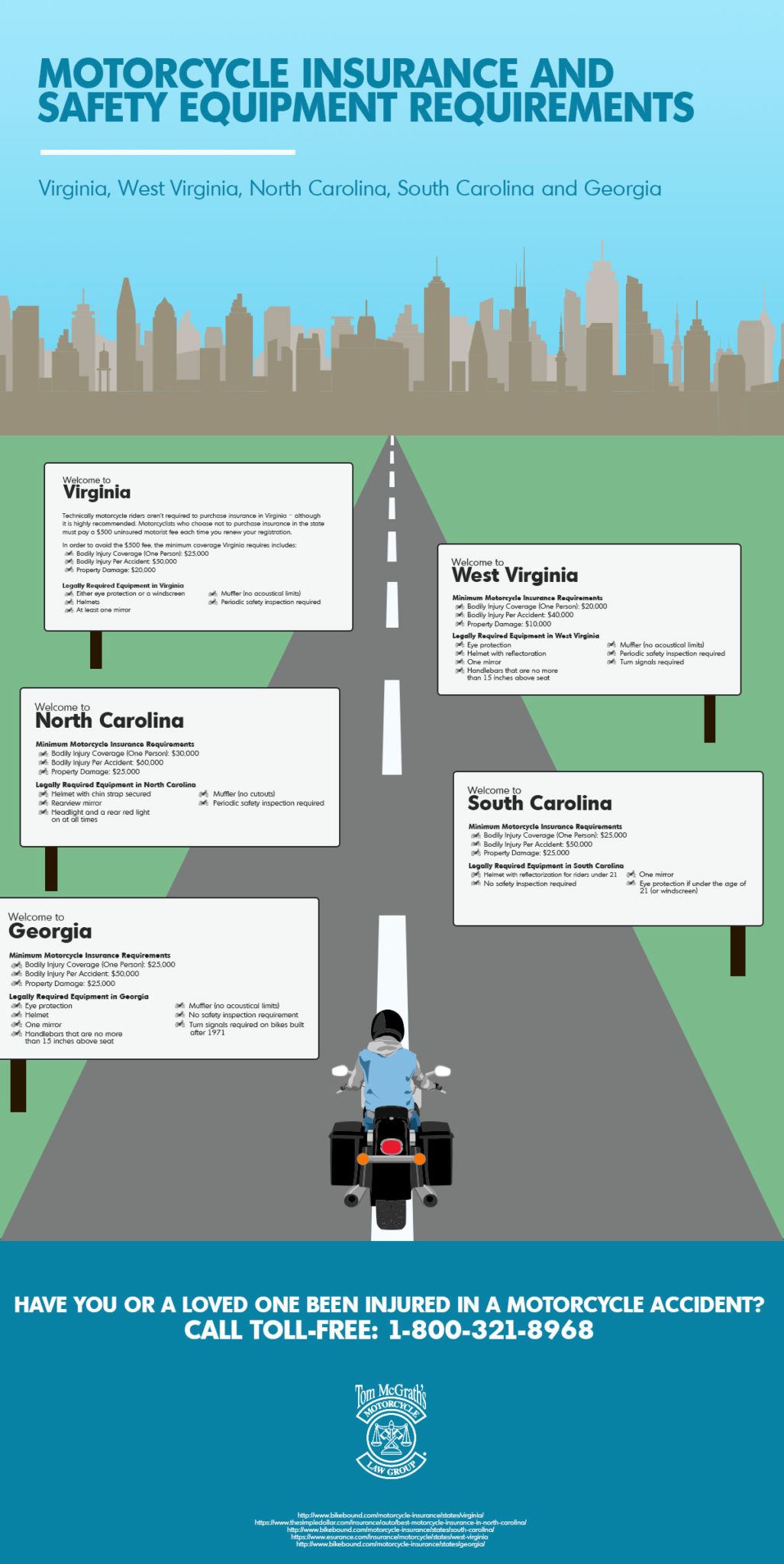

The states we serve require minimum coverage ranging from $20,000 to $30,000 of bodily injury coverage per person, $40,000 to $60,000 of bodily injury coverage per accident and $10,000 to $25,000 of property damage coverage.

Make sure to look through our accompanying infographic for more details on the exact coverage limits in your state.

Collision Coverage for Motorcycles

It’s important to understand that the minimum required property damage coverage is intended to be used on your behalf if you cause an accident that damages someone else’s property. It’s not necessarily intended to cover repairs to your own bike.

Collision coverage will pay for your own repairs in the event your bike is damaged in a crash with a car or you collide with some other type of stationary object, like a tree, lamp post or fence.

Comprehensive Coverage

Collisions are not the only risks for motorcycles. Comprehensive coverage will pay for repairs or replacement if your bike is stolen, vandalized or is damage in some type of disaster like a fire or flooding.

Life is full of unforeseen events, so if you want your insurance to cover as many potential hazards as possible you should really consider comprehensive insurance.

Uninsured and Underinsured Motorist Coverage

As a rider you understand better than most motorists that there are a lot of irresponsible people on the road. Some of those irresponsible motorists fail to purchase the legally required auto insurance coverage.

If you are involved in an accident with a negligent, uninsured driver, you could potentially be forced to pay for damages and injuries out of your own pocket. Uninsured motorist coverage protects you if that happens, and greatly increases the chance your damages will be covered without having to resort to legal actions.

Underinsured motorist coverage operates under the same concept, which is why they’re rolled into one. A lot of motorists can only afford, or choose to only purchase, the minimum required coverage. Those limits won’t go very far in serious accidents that result in traumatic injuries, which are all too common for riders. Underinsured motorist coverage kicks in when the responsible driver’s insurance coverage limits are reached.

Consider Your Options Before Choosing the Cheapest Solution

There are a lot of products and expenses where you can get away with only paying for the cheapest option. Insurance is not one of those things. Insurance isn’t just for protecting you and your bike – although that is certainly important. It’s about protecting your family and loved ones and ensuring that if the worst were to happen, they wouldn’t be saddled with medical debt and no income to help pay it off.

Think twice before getting on the road without motorcycle insurance coverage. Strongly consider adding collision, comprehensive and uninsured motorist coverage to your policy. The annual cost is far lower than the lifetime costs of getting in an accident and not being adequately covered.

Get a Motorcycle Insurance Policy Review from the Motorcycle Law Group

Insurance is complicated. The easiest thing you could do is call Geico and get the cheapest coverage possible, but if you do ever get in an accident you could find yourself at a significant financial disadvantage. One of the services we provide to fellow riders is a free motorcycle insurance review. We’ll take a look at your policies and advise you on:

- Getting the best coverage for your bike based on your risk level

- How to organize multiple policies to maximize your coverage

- Where you may need more coverage or areas where you’re overprotected and can cut back

- The important policy limits and whether you would be adequately covered if you have a significant property damage or injury claim

We also encourage you to check out ourfree prepared rider kit for advice on valuing your bike, what to do after an accident and ensuring all your gear and bike are adequately covered.

You can claim yourfree motorcycle insurance policy review on our website or call us toll-free at(855) 529-7433 for a free motorcycle accident consultation.